Build and Operate

Customized Solution

AI and Analytics

Quick Go Live

LTFLoW

Fueling Businesses with Collaborative – AI Powered Infrastructure

2.5 M

Users on boarded

2000 CR

Gross Loan Value

50 +

Business Partners

Solutions

A Comprehensive Module Portfolio that helps businesses improve agility in primary domains like Loan origination, Product, Credit decisioning, Loan servicing, Underwriting, collections and analytics.

Request a Call for more information

Our team shall call you within 24 hours!

Customer Testimonials

Request a Demo

Case Studies

Client – MAS

To source customers, Low income, and good credit profile for the product Impact term Loan.

MAS proposed to Source Impact Loan from various destination and create a filters as per the requirement.

- Gpay Mini App to Source Low Income Target customer for Impact Loan

- Bureau analytics and AI to filter and predict application propensity and credit worthiness

- Custom Interface for MAS to do in-house Dedupe and Approval

- Custom designed Credit appraisal Memo (CAM) reports for approval

- Automated MIS and reports

Additional 3 CR loan booked for Impact

Client – Bank of Maharashtra

To source online applications for different products for Public sector Banks.

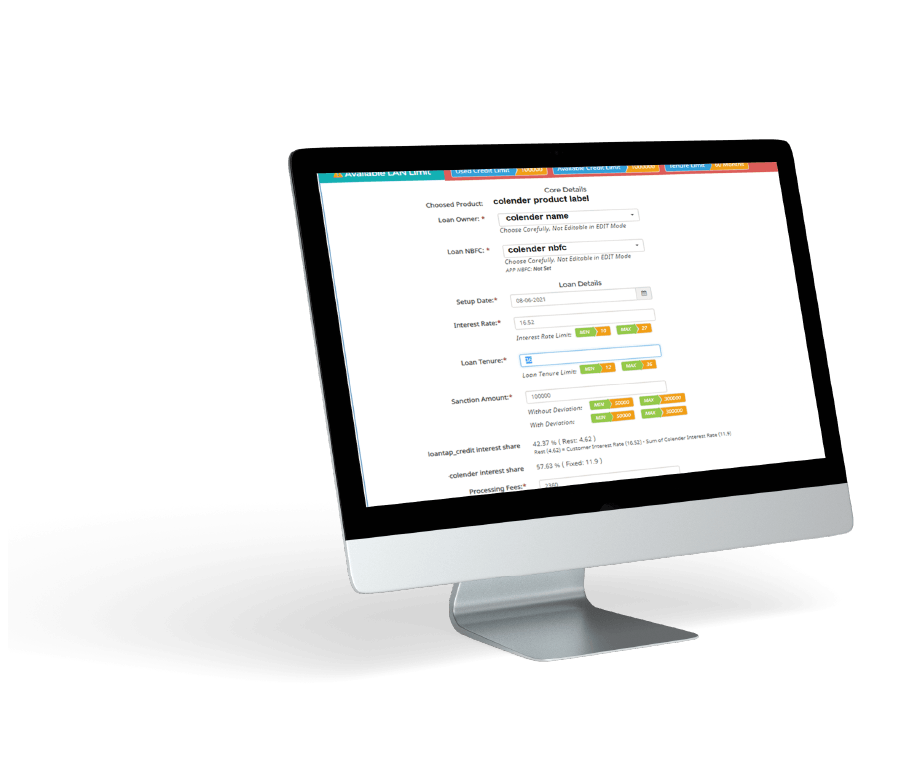

Bank of Maharashtra wanted a co-lending platform to Co-lend and should support Multiple lending partners in their backend.

- LT created the entire Co-lending platform, and provided Middleware and CBS system to them.

- We have designed the customized Disbursal construct with LoanTap.

- The Disbursal calculation construct is implemented in a system for easy Disbursal and PF amount collection.

- Middleware integrated with the LoanTap system.

- Approx. 6.5 Cr co-lending done at 20-80 disbursal model with BOM .

- The platform is integrated for LendingKart- BOM co-lending model .Integration with MAS is in progress

- BOM co-lending with LendingKart is progressing well on this platform .

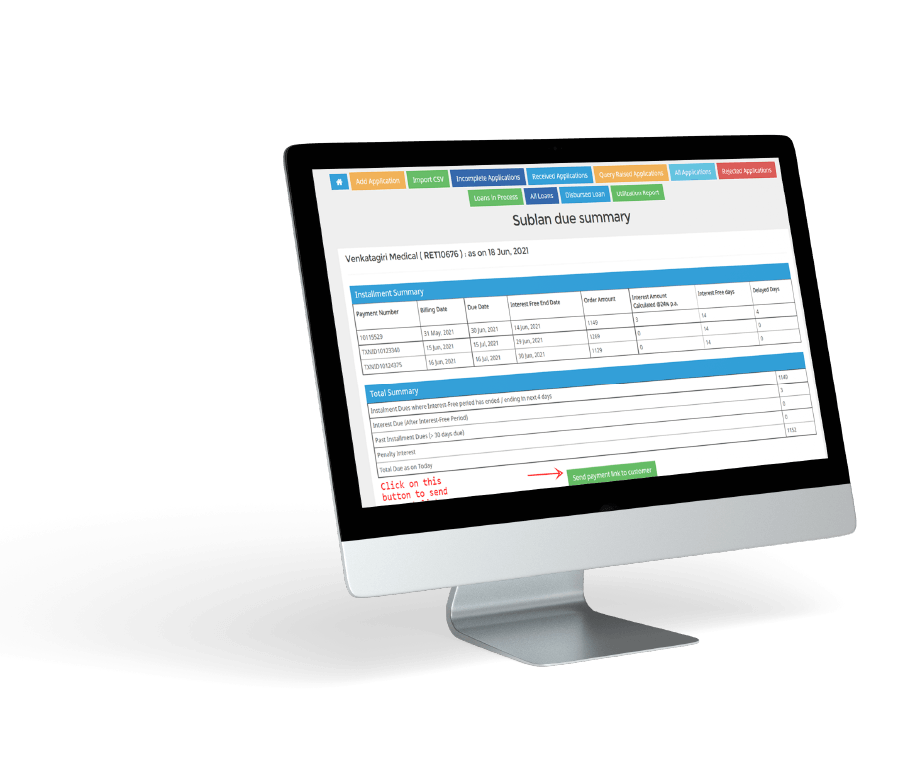

Client – Saveo

Saveo wanted to provide their Retailers with a credit line. Saveo to share leads and LT to Underwrite and Disburse the loan under Interest subvention Model.

Saveo applications get sourced from LTplus app and Dashboard,. Gets Approved within 15 mins and Disbursed within 24 HOURS.

- Saveo disbursal size 1.5 crore monthly.

- 50% Upfront Rejection, High lead conversion has gone to 75%-AI model

- Able to predict default with 95% conviction

- 93% of application getting converted to loans using Decile scoring Model

Client – LoanTap

To Restructure loans under the framework of the guidelines.

The stress faced by the Borrower/Co-Borrower(s) should be on account of the COVID-19 pandemic.

The loan should be classified as Standard Asset by the Company as on March 31, 2021.

The loans restructured under the Resolution Framework 1.0 for COVID-19-related Stress shall not be eligible for fresh restructuring except where the full benefit of extension of residual tenor by 24 months was not availed

- All the cases to be Restructured as per guidelines

- NACH Presentation to be stopped during the Moratorium Period

- Interest components including interest on interest shall accrue during the Moratorium period for all the cases, would be added to the principal on a month-on-month basis.

- Penal interest & bounce charges shall not accrue from the date of implementation during Moratorium period

Identified a total of 1,986 cases and proposed to grant further moratorium to 1,530 cases.